Approved Tax-Deferral Strategies To Better Compound Your Returns

December 10th, 2025

5 min read

Tax deferral strategies help investors keep more of their returns working for them by postponing tax payments until a later date. Common tools include 1031 exchanges that delay capital gains on property sales, retirement accounts like IRAs and 401(k)s, and accelerated depreciation that lowers taxable income up front. Using these strategies wisely can boost long-term growth and improve cash flow, but you need to understand the rules and timing to avoid surprises.

If you're investing in real estate but leaving your tax strategy to chance, you could be missing out on some of the easiest money you’ll ever make.

The smartest investors know it’s not just about how much you earn. It’s about how much you keep, and how long you can keep it working for you.

Tax-deferral strategies like 1031 exchanges, Delaware Statutory Trusts, Opportunity Zones, and accelerated depreciation help you stretch your investment dollars further. When used correctly, they allow you to reinvest gains, delay tax obligations, and keep your capital compounding over time.

This guide breaks down the most effective tax-deferral tools for real estate investors. If you're looking to grow your portfolio without taking on more hands-on work, these strategies can help you stay focused on what matters most: building wealth with less friction.

1031 Exchange Rules: How To Defer Taxes By Reinvesting In Real Estate

A 1031 exchange allows you to sell one investment property and reinvest the profits into another, without immediately paying capital gains taxes. Rather than cashing out and handing over a chunk to the IRS, you move that equity into a new property and defer the tax.

It’s like trading up on a home without losing part of your down payment. You keep your money in motion and avoid interrupting the compounding effect of reinvested capital.

How To Use A 1031 Exchange

- Sell an investment property.

- Reinvest the proceeds into another like-kind property.

- Identify the new asset within 45 days and close within 180 days.

Benefits Of A 1031 Exchange

- Defers capital gains taxes.

- Helps scale into larger or better-performing assets.

- Can be used repeatedly to defer taxes across multiple deals.

Drawbacks Of A 1031 Exchange

- Requires strict timing and IRS compliance

- Replacement property must be held for investment, not personal use

- Often requires active management, which may not appeal to passive investors

Many investors underestimate how much they’ll owe in capital gains taxes, especially after years of appreciation. A 1031 exchange can help keep more of that gain working for you. It allows you to reinvest in higher-performing or more diverse assets rather than shrinking your next purchase due to a large tax bill.

Delaware Statutory Trusts (DSTs): Passive Investing Through A 1031 Exchange

A Delaware Statutory Trust (DST) allows you to invest your 1031 exchange proceeds into a professionally managed property. Instead of direct ownership, you buy a fractional interest alongside other investors, and the sponsor handles all operations.

This setup is ideal for passive real estate investors who want to defer taxes without the work of managing another property.

DST 1031 Exchange Benefits

- Eligible for 1031 exchanges.

- 100% passive with no management responsibilities.

- Access to institutional-grade commercial real estate.

DST Risks & Considerations

- You have no control over property decisions.

- Funds are typically illiquid for 5 to 10 years.

- Sponsor and management fees can reduce returns.

DSTs are a smart move for investors looking to transition out of active management without triggering capital gains tax. You get stable income potential and hands-off investing while maintaining your tax deferral.

Qualified Opportunity Zones: Tax Deferral For Long-Term Capital Gains

Qualified Opportunity Zones (QOZs) were created to attract investment into underserved communities. By reinvesting gains into a Qualified Opportunity Fund (QOF), you can defer taxes and potentially eliminate tax on future appreciation.

This strategy is unique in that it allows investors to take gains from non-real estate assets (like stocks or a business sale) and reinvest them into real estate development or rehab projects within designated areas.

How Opportunity Zone Funds Work

- Invest capital gains into a QOF within 180 days.

- Defer taxes on original gain until 2026.

- Hold for 10+ years to eliminate taxes on new appreciation.

Opportunity Zone Tax Benefits

- Temporary tax deferral.

- Potential for permanent exclusion of future gains.

- Broader eligibility (not limited to real estate investors).

Risks of Opportunity Zone Investments

- Long holding periods are required.

- Development-focused projects can increase risk.

- Only applies to government-approved census tracts.

One of the most flexible aspects of Opportunity Zones is that they’re not limited to real estate proceeds. Investors with capital gains from stocks, business sales, or other non-property sources can participate as well, making QOZs appealing to a wider range of investors.

That said, not all Qualified Opportunity Funds are built the same. Some invest in high-risk, ground-up development projects, while others focus on stabilized assets in up-and-coming neighborhoods.

Always review the fund’s asset mix, management team, and long-term strategy before jumping in.

Cost Segregation Tax Strategy For Commercial Real Estate Owners

Cost segregation allows you to accelerate depreciation by separating out building components (such as fixtures, flooring, or mechanical systems) that can be depreciated over shorter periods.

It’s like peeling an onion. A building may look like one unified asset from the outside, but underneath, it’s made up of dozens of parts that age differently. Cost segregation lets you recognize that and take deductions sooner where they make sense.

Advantages Of Cost Segregation

- Boosts early-year tax deductions.

- Improves after-tax cash flow.

- Can be combined with bonus depreciation.

Considerations Before Using Cost Segregation

- Requires a professional engineering study.

- May increase depreciation recapture at sale.

- Works best for direct property owners (not DST investors).

This strategy is especially useful for high-income investors who own commercial property directly and want to reduce their taxable income sooner rather than later.

Bonus Depreciation In 2025: How It Works With Real Estate

Bonus depreciation lets you write off a large portion of qualifying property in the year it’s placed into service. When paired with cost segregation, it becomes one of the most powerful tools for upfront tax relief.

Bonus Depreciation Phase-Out Schedule

- 2023: 80%

- 2024: 60%

- 2025: 60%

- 2026: 40%

- 2027: 20%

NOTE: There’s always a possibility that future tax legislation could modify this schedule. Some lawmakers and industry groups have advocated for extending or reinstating 100% bonus depreciation. But as of now, the phase-out remains in effect as written in the current law.

Pros Of Bonus Deprecation

- Maximizes tax deductions in the first year.

- Improves early returns on real estate investments.

- Can offset other passive or active income.

Bonus Depreciation Limitations

- Phasing out over time unless extended by Congress.

- Limited to qualifying assets.

- Increases depreciation recapture liability at sale.

If you’re earning a high income and want to reduce your tax bill this year, bonus depreciation, especially when combined with cost segregation, can deliver a meaningful advantage.

Why Tax Deferral Strategies Matter For Passive Real Estate Investors

As a passive investor, your goal is simple. You want your capital to generate income and long-term growth, without constant oversight or unnecessary friction.

Tax-deferral strategies help you do just that by allowing you to:

- Reinvest profits without triggering immediate taxes

- Keep more capital compounding

- Improve after-tax yield over time

Most new investors think taxes are just part of the deal, but proper planning can significantly reduce the drag they place on your returns.

These tax code strategies reward long-term investment and can help your money grow without increasing risk when used wisely with the help of advisors.

Want to keep building your financial knowledge? Check out the RockStep Capital Learning Center for clear, beginner-friendly articles and e-books on passive income, retail investing, and real estate strategies that actually make sense. You can also dive into short video content on the Shopping Center Channel, featuring rich, behind-the-scenes property tours and real-world investing advice that bring these concepts to life.

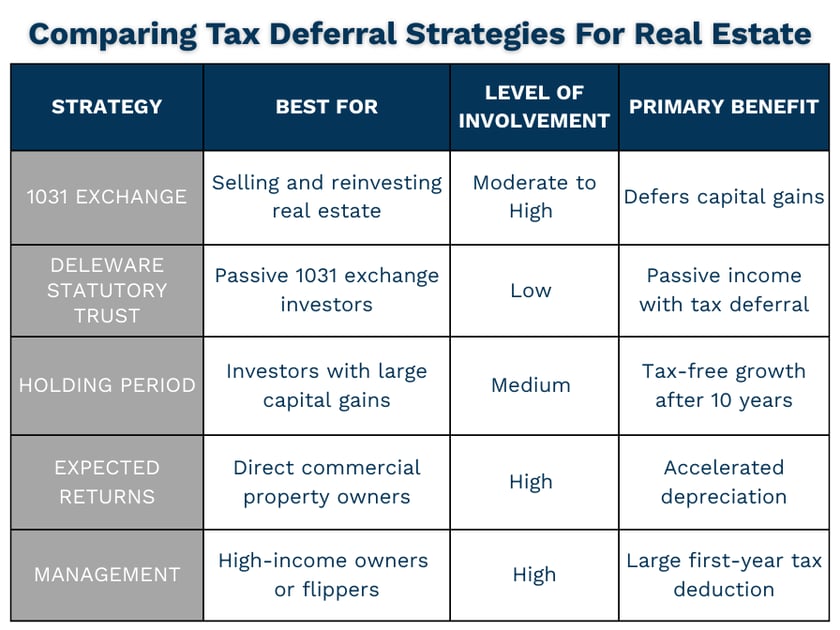

Compare Tax Deferral Strategies For Real Estate Investors

Final Thought: Build Smarter, Keep More, Grow Faster

Tax deferral is a key strategy for protecting gains and growing your portfolio more effectively. Whether you're exchanging property, exploring Opportunity Zone funds, or maximizing depreciation through cost segregation, these tools allow your money to work harder for you.

For passive investors, this matters even more. You’re not looking to take on more work. Instead, you’re looking to make your capital work harder. These strategies let you do that without adding complexity to your lifestyle and shift the pace of wealth-building in your favor.

The bottom line? The right tax strategy doesn’t just help you grow. It enables you to expand on your terms, with more control, better timing, and less friction along the way.

Topics: