Why should you invest in retail?

Investment in the commercial real estate retail market is in fashion. The next three to four years offer an unprecedented opportunity to generate passive income and generational wealth in the retail sector.

This is a rare opportunity to capitalize on the perfect storm.

The next few years will offer a phenomenal opportunity to create wealth in the retail investment space. Here is what you might miss if you do not invest:

Stakes Bullet Label

Mauris purus urna, dictum non cursus et, congue et felis. Suspendisse porttitor mi et eros luctus suscipit.

Learn MoreStakes Bullet Label

Mauris purus urna, dictum non cursus et, congue et felis. Suspendisse porttitor mi et eros luctus suscipit.

Learn More

The Opportunity

The shopping center sector is having a moment. And you don't want to miss out on it.

Retailers that survived the Amazon Effect, along with COVID-19, are growing rapidly. The strong who survived have shown that even retailers with the strongest eCommerce strategy have realized the importance of a robust brick-and-mortar presence to sustain growth.

But it doesn't stop there. There is an estimated $50 billion worth of insolvent debt coming due in the enclosed mall space over the next three years. This creates an extraordinary opportunity to acquire low-risk, high-upside properties at a fraction of their intrinsic value.

Let's face it. Rumors of retail's demise have been greatly exaggerated. This is your opportunity to capitalize on the fact that not everybody knows about it.

Start InvestingThe time is now!

Several factors have come together to make NOW an incredible time to create legacy wealth in the retail sector.

Slow and steady builds a legacy

By focusing on low-risk investments with high upside, you can look forward to years of passive income rolling in.

50 billion reasons to invest in retail

With an estimated $50 billion in insolvent debt coming due in the enclosed mall sector over the next three to four years, there will be remarkable opportunities to acquire low risk/high reward investment properties.

Current Retail Vacancy Rate

According to CoStar, there is less space available for lease now than at any point since national tracking began in 2006.

Insolvent Debt

Over the next three years, banks and lenders will foreclose on over an estimated $50B of loans on shopping malls.

Retailers Expanding Footprint

Seven out of eight retailers are currently looking to expand their footprint.

Why is Now the Right Time?

All the factors are lined up to make the shopping center sector a safe bet for investors looking to create a steady flow of passive income.

A maturing eCommerce market, brands who have proven they can stand the test of time and a flurry of low risk, high reward investment opportunities set to hit the market over the next three or four years are only a few of the reasons the retail sector has so much upside.

Amazon Effect Maturing

- Amazon and COVID killed most of the weak retailers.

- Survivors are growing and have strong balance sheets.

- Physical, brick-and-mortar stores provide the lowest cost way to acquire new customers.

- Retail looks good compared to other real estate sectors.

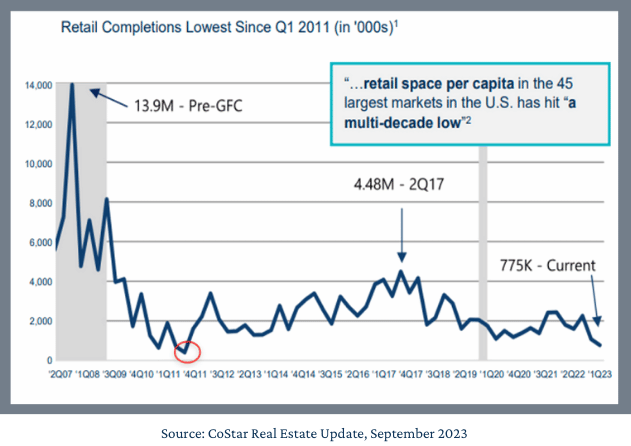

Historically Low New Retail Development

Over the past 13 years, new retail development has reached a historical low due to high construction costs. Retail remains the lowest of all commercial real estate sectors at half a percent of shopping center construction growth per year.

This lack of supply is driving up the value of second-generation space, which creates a tremendous opportunity.

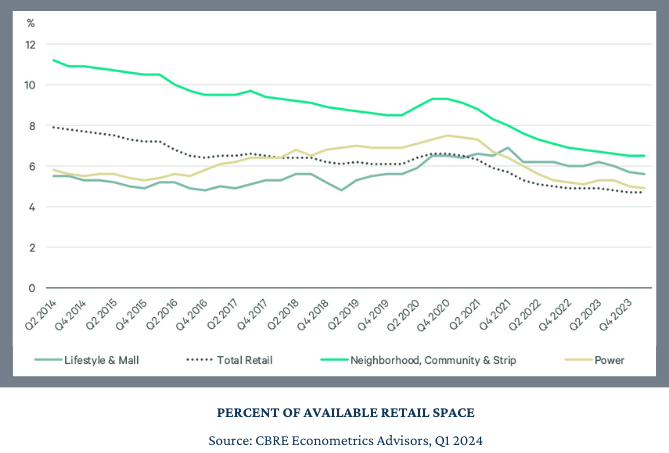

Low Space Availability

“The 10 consecutive quarters of demand growth have pushed the retail market into its tightest position in nearly 20 years. There is less space available for lease now than at any point since national tracking began in 2006.”

- CoStar Group, Q3 2023

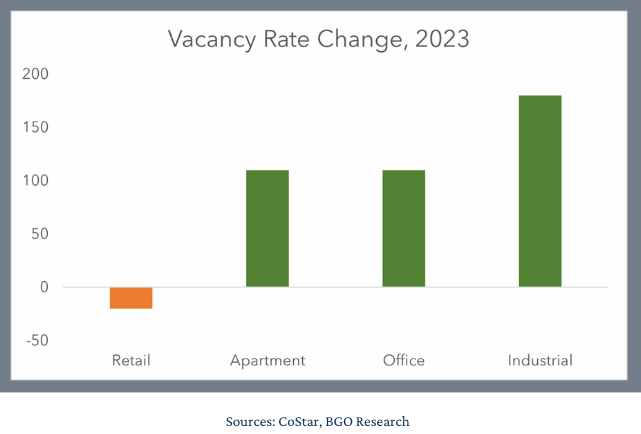

Retail Remains Incredibly Strong

Retail is the only major real estate sector that experienced a decrease in vacancy in 2023.

Industrial, Office, and Multifamily all experienced significant increases in vacancy.

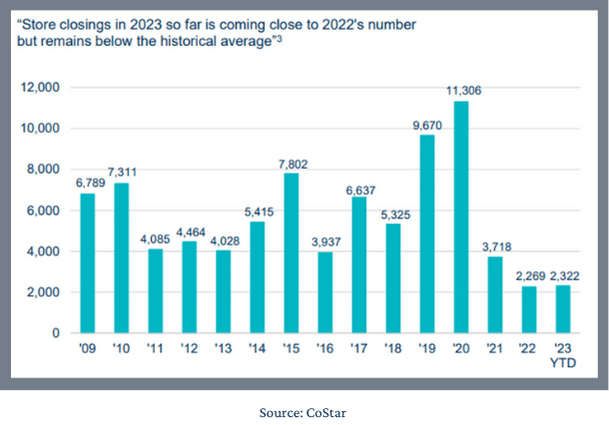

Store Closures Near Historic Lows

The Amazon Effect, followed by the global pandemic in 2020, had a major impact on store closures.

Over the last three years, store closures have leveled off and now are sitting below the historical average.

We Invest in "HomeTown" Markets

We invest primarily in secondary and tertiary markets where we can buy credit-quality cash flow at lower prices compared to the major metros.

These "hometowns" have a community spirit different than larger markets that allow RockStep to bring in local investors, reducing risk during the life of the asset.

RockStep is able to identify local investors and business owners who care about their community and want to invest with somebody who can bring capital and expertise to assets that affect quality of life.

What is a HomeTown?

100k to 950k Market Population

Exhibits Community Pride

Engaged City Leadership

High Quality of Life

Highly Rated School System

Low Crime Rates

Low Cost of Living

Growing Population

Essential Market Drivers

Benefits of Investing in HomeTowns

Lack of Institutional Competition

Deals are too small for larger investors to bother with.

Community Buy-in

Local leaders, investors, and lenders are committed to building thriving communities and are eager to partner with groups that have expertise and the capital.

Virtually No New Supply

There is less concern about new supply coming into the market due to high construction costs and the ability of the market to absorb new square footage.

High Cashflow

You get the same cash flow and tenant credit quality at a lower price.

Ability to Acquire Multiple Assets

It’s much easier to acquire additional properties within the market, which provides you with the ability to have greater control of rental rates.

Why HomeTowns Want to Partner with Us

Start InvestingWe’re Experienced Operators

Working closely with a group led by someone whose family has been in the retail space for nearly 100 years gives them confidence that we will execute.

Aligned Mission and Values

We are a mission-driven company with a strong management team focused on revitalizing hometowns. That is unique and is immediately recognized by them.

Access to Outside Capital

Finding someone willing to infuse outside capital into their communities is challenging. Investing our capital alongside theirs helps them accomplish their goals and objectives that wouldn’t be possible otherwise.

Tenant Relationships

HomeTowns want access to the same retailers, restaurants, and entertainment options larger cities have. We can help attract those tenants.

We have strong relationships with most of the fastest-growing retailers in the country

Our Case Studies

To get a better feel for the types of properties we acquire, how we add value to those properties and mitigate the risks, take a look at a few of our success stories:

Get Started

You can learn a lot about the RockStep Way by reading the content on our website. Once you do that, the next step is to schedule a call with one of our retail real estate investment experts.

Schedule a Discovery Call

The first step is determining whether we’re a good fit for you and vice versa. Schedule a time to meet with one of our Passive Investing Specialists.

Invest with Confidence

We aim to help you achieve financial and time freedom so you can spend your time doing what you love with the people you love.

Leave Your Legacy

Not only secure your family’s long-term financial health, but directly influence and give back to HomeTown America.

Why is this such a good time to invest in shopping centers?

All the factors are lined up to make the retail sector a place for investors looking to create a steady flow of passive income.

A maturing eCommerce market, brands who have proven they can stand the test of time, and a flurry of distressed investment opportunities set to hit the market over the next three or four years are only a few of the reasons the retail sector has so much upside.

You can reach out to us and discuss this opportunity to build generational wealth with our President, Andy Weiner.

FAQs

Below are a few frequently asked questions investors have about investing passively in the retail sector.

What types of retail properties do you buy?

Broadly speaking, we acquire "shopping centers," which are a subset of the retail sector. Our expertise is in acquiring enclosed shopping malls, open-air power centers, and neighborhood shopping centers in HomeTowns across the United States.

Enclosed Shopping Malls:

- Two or more anchor tenants

- Centrally located

- 300k - 1MM+ square feet

Open-Air Power Centers:

- Multiple Anchors

- Anchor tenants (e.g., Best Buy, Hobby Lobby, T.J. Maxx, Ross Dress for Less, etc.) comprise 75%+ of the rentable square footage in our portfolio.

- 150k - 500k square feet

Neighborhood Shopping Centers:

- One to three anchor tenants

- When possible, a grocery store

- 50k - 150k SF

Aren't shopping malls "dying"? Why do you buy them?

While there are certainly shopping malls that have become functionally obsolete over the years, and the land they are located on could be redeveloped for higher and better use, there are many more that have plenty of life left in them. As is often the case with real estate, location matters.

Many malls were acquired by their current owners before Amazon disrupted the retail sector. They were purchased at prices that were much too high using bank debt. Those owners are now facing foreclosure as the values have plummeted, and the income generated from the property can no longer cover the loan payments.

This presents an opportunity to acquire these properties at prices close to the value of the underlying land. Essentially, there are opportunities to buy the land and get the building for free. These opportunities come with pre-existing net cash flow from the rents being collected from the existing tenants. This can represent anywhere from 15 to 20% of the purchase price annually. In other words, you can potentially acquire a property, hold it for five to eight years, and recoup your entire purchase price when you sell, assuming you can maintain the current tenants at their current rents.

The opportunity is heightened further by the fact that very little new retail space is being developed due to increased construction costs and higher-than-average interest rates. This has led to near-historic lows in vacancy. Currently, your average shopping mall has a vacancy rate of below five percent. It's a simple matter of supply-and-demand.

The barrier to entry for owning and operating shopping malls is relatively high. It requires expertise that most real estate investors don't have, such as property management, leasing, and construction management. While competition exists, it's not nearly as competitive as the multifamily or industrial sectors are.

RockStep has owned and operated shopping centers since 1997. Founder and President Andy Weiner has spent his entire adult life working in the retail sector.

What do you do to increase the value of the properties after you acquire them?

The primary way to increase a shopping center's value is to increase its net operating income. This is accomplished by increasing rental income and decreasing expenses.

The other strategy for increasing the overall return on a property is to sell off parts of the property to individual buyers. Sometimes the sum of the parts is greater than the whole.

As it pertains to increasing the net operating income, here are a handful of tactics that one may employ:

- Increase existing tenant rents to the current market rate rents.

- Replace an existing tenant with one or more tenants who are willing and able to pay higher rents.

- Fill vacant space with new tenants.

- Attract tenants that increase foot traffic to the property.

- Repurpose some of the less desirable space with non-retail tenants.

- Work with the local municipality to institute an increased sales tax on goods sold at the property.

There are many other strategies and tactics that can add value to a property. The key to most of them is having the ability to be creative and the experience necessary to execute them.

What are the significant risks involved when purchasing shopping centers?

There are a handful of key risks that need to be taken into account when owning and operating shopping centers. It's easier to frame risk from the perspective of what could happen if an inexperienced investor attempted to operate a shopping center.

- They use too much leverage, such as a small down payment, and have inflexible loan terms.

- They don't account for the fact that they may have issues with permitting, zoning, and tenant consent, which involves getting permission from one or more anchor tenants to make changes to the property.

- They don't account for the fact that property taxes and property insurance can increase significantly.

- They don't have any relationships with their major national tenants.

- They lack community buy-in. Or even worse, they have an adversarial relationship with the local community. This makes it extremely challenging to execute their business plan on seemingly simple things, like installing signage to increase visibility.

- They don't have proper cash reserves to fund tenant and property improvements, which makes it challenging to attract high-quality tenants.

- They assume the existing tenants will renew their lease when the time comes or that they are in a strong enough financial position to not default on their lease.

- They end up overpaying for the property because they didn't completely understand all of dynamics that go into operating a mall.

To effectively mitigate risks, you need to understand them first. Once you know them, you're in a better position to mitigate them.

At RockStep, we make sure that we conduct an appropriate amount of due diligence ahead of time to ensure that we buy the property at a proper price. We then raise enough equity so that we only have to borrow around 50% of the purchase price, which gives us a margin of safety should property values fall. We develop relationships with community leaders who invest their equity capital alongside us in the project, creating alignment between us and the community.

Why do you buy properties in "HomeTowns" instead of the major markets?

In the commercial real estate world, we refer to the major markets as "primary" markets This would include markets like New York, Miami, Houston, San Francisco, and Los Angeles. When we say "HomeTowns," we are referring to "secondary" and "tertiary" markets.

The reason we like "HomeTowns" is that we are able to purchase properties at a much lower price while attracting many of the same high-quality tenants found in larger markets. And very often these tenants are willing to pay rents that are very similar to the rents in larger markets.